Understanding Rent-to-Own Cars: A Comprehensive Guide

Outline

Before you decide whether a rent-to-own car makes sense, it helps to see the road ahead. This guide starts with a clear blueprint, then moves through practical details, numbers you can check, and choices you can tailor to your situation. Use the outline below to jump to the parts that matter most for your budget, timeline, and comfort with risk.

– Section 1: How rent-to-own works. We define the model, explain the agreements you’ll sign, and walk through what happens from the first payment to the moment title transfers. You’ll see how it differs from traditional financing and leases, including return and reinstatement rules.

– Section 2: The true cost. We break down weekly or biweekly payments, upfront fees, late penalties, and the total you might pay over the term. Then we compare those costs to common alternatives, using simple, illustrative math you can replicate with your own numbers.

– Section 3: Eligibility, credit, and legal considerations. Expect insights on income verification, proof-of-residence requirements, whether your payments help your credit profile, and what consumer protections may apply based on location. We also share a contract-reading checklist.

– Section 4: Vehicle condition, maintenance, and insurance. You’ll learn how to evaluate used cars in rent-to-own fleets, what maintenance responsibilities typically fall on you, and how insurance requirements can affect monthly costs. We include a practical inspection list and coverage essentials.

– Section 5: Alternatives and decision framework. We lay out other paths—traditional loans, car subscriptions, short-term rentals, and saving-to-buy—and give you a quick decision tree that balances speed, reliability, and total cost of ownership. At the end, a concise conclusion ties everything together for a confident next step.

Think of this article as a map: you bring your destination, and we highlight the turns, roadblocks, and scenic routes. Whether you want a stopgap car to get to work next week or a plan to own a vehicle outright in a year or two, the sequence of sections is designed to help you weigh convenience against long-term value without stress or guesswork.

How Rent-to-Own Cars Work: Mechanics, Terms, and Typical Clauses

Rent-to-own (RTO) car programs blend elements of short-term rental and installment purchase. Instead of securing a traditional auto loan, you rent the vehicle and make frequent payments—often weekly or biweekly. After a defined number of on-time installments, you can acquire ownership, usually with a small final transfer fee. If you stop paying, the agreement often lets you return the car without the same credit consequences as a repossession under a standard loan, though you lose the money already paid and may owe fees.

Here’s the typical flow: you select a used vehicle from an RTO inventory, provide identification and proof of income, pay an initial amount (sometimes called an acquisition or initiation fee), and sign a rental agreement that outlines payment frequency, term length, mileage rules (if any), and maintenance responsibilities. Many providers use simple schedules: for example, $120 per week over 156 weeks. If you make each payment, the title transfers to you at the end, sometimes after a modest final charge. If you fall behind, some programs allow reinstatement—paying the past-due amount and a fee to keep the contract alive. Others may require the vehicle’s return and a restart later.

What you’ll commonly see in RTO agreements:

– Frequent payments (weekly/biweekly) to align with paycheck cycles.

– Flexible returns: you can often return the vehicle early, which can limit further obligations but does not refund prior payments.

– Telematics devices: GPS trackers or starter-interrupt technology may be installed to manage risk and aid recovery after payment default.

– Maintenance expectations: oil changes and routine upkeep typically fall on you; coverage varies for major repairs.

– Title transfer conditions: ownership passes only after all installments and fees are satisfied.

How RTO differs from other paths:

– Versus a loan: loans require credit approval and carry fixed monthly payments, with immediate ownership and a lien; RTO offers easier access for limited credit but postpones title until completion.

– Versus a lease: leases are built for new or near-new cars, with mileage caps and end-of-term options; RTO targets used vehicles with simplified, pay-as-you-go structures and a clear pathway to eventual ownership.

– Versus daily rentals: daily rentals are short-term and include insurance in the rate; RTO stretches over months or years, and you source your own insurance.

Illustrative example: if a $9,500 used car is offered at $120 per week for 156 weeks, you pay $18,720 in rent-to-own installments, plus any fees. That premium reflects convenience, approval flexibility, and risk management. The trade-off is speed of access versus the higher overall cost you agree to shoulder for that convenience.

The True Cost: Payments, Fees, and Real-World Comparisons

Understanding total cost of ownership is central to an RTO decision. While weekly payments feel approachable, they can obscure the long-term price. Common cost components include the base rental payment, acquisition/initiation fees, taxes, a final transfer fee, late charges, reinstatement fees, and sometimes device-related fees tied to GPS or starter-interrupt hardware. Because payments are frequent, small delays can trigger penalties, and those accumulate quickly.

Consider an illustrative scenario. Vehicle cash value: $9,500. Weekly payment: $120. Term: 156 weeks (three years). Total scheduled payments: $18,720, excluding fees. Add an acquisition fee of $300, a final transfer fee of $150, and assume two late payments at $25 each; the subtotal becomes $19,220 before insurance and maintenance. By contrast, a traditional loan at 10% APR over 36 months for $9,500 yields an estimated monthly payment near $306 and a total near $11,000–$11,200, depending on taxes and fees. The RTO premium, in this example, compensates for flexible approval and the option to return the vehicle, but it’s a substantial cost trade.

Where do these extra dollars go? Programs price in higher risk (non-prime customers, older vehicles), inventory reconditioning, and the convenience of walk-in access with minimal credit hurdles. For many shoppers, the real question is not whether RTO is cheap—it usually isn’t—but whether the value of immediate mobility and flexible return outweighs the premium.

How to evaluate your own numbers:

– Convert weekly to monthly by multiplying by 4.33, then compare to a loan payment estimate.

– Add all fees and estimate routine maintenance (oil, tires, brakes). Used vehicles often need $600–$1,200 per year in upkeep, depending on age and mileage.

– Estimate insurance: liability is mandatory in most regions; comprehensive and collision may also be required by the contract. Rates vary with driving record, location, and vehicle type.

– Consider your timeline: if you expect to return the car in six months, compute the total for that window, not the full term.

Alternative comparisons can clarify value:

– Public transit plus occasional short-term rentals can cost far less if you drive sparingly.

– A small personal loan from a local lender or cooperative may reduce total cost if you qualify.

– Car subscriptions bundle payments, maintenance, and insurance into one fee; they trade higher monthly cost for simplicity and flexibility.

Bottom line: price every option using the same timeframe and include taxes, fees, maintenance, and insurance. The most transparent math wins—and puts you in control of the decision.

Eligibility, Credit Factors, and Legal Considerations

Many RTO programs aim to serve shoppers with thin or challenged credit files, which is why approval often leans on current income and residence stability instead of traditional credit scoring. You can expect to provide pay stubs, bank statements, and proof of address. Some agreements note that on-time payments may not be reported to major credit bureaus, limiting potential credit-building benefits. Late or default activity, however, could be reported, which means RTO sometimes offers asymmetrical credit impact: easier access without equivalent upside for positive payment history.

What to confirm at application:

– Will on-time payments be reported to consumer reporting agencies? If so, how frequently?

– What documentation is required, and how is affordability evaluated?

– Are co-signers allowed, or is the contract designed solely for the primary driver?

Legal frameworks vary by location. In some jurisdictions, RTO contracts may be regulated under rental or consumer lease laws rather than standard retail installment sales, which changes your rights and remedies. Key elements to review include reinstatement rights after default, permitted fees, required disclosures, and dispute resolution processes. Some regions require clear disclosure of total scheduled payments, an itemized list of fees, and the conditions for obtaining title. Return provisions are also crucial: returning the vehicle may limit further obligations but does not typically refund prior payments.

A contract-reading checklist helps avoid surprises:

– Identify every fee by name and amount: acquisition, late, reinstatement, device, transfer, and taxes.

– Note payment frequency, grace periods, and how weekends or holidays are handled.

– Confirm maintenance responsibilities, included warranties (if any), and your obligations for breakdowns.

– Understand telematics clauses: what data is collected, how it’s used, and when a starter-interrupt might be engaged.

– Verify insurance requirements and documentation deadlines.

If a dispute arises, first contact the provider in writing and keep copies of all communications. If local consumer protection agencies or ombudsman services are available, they can guide you on applicable laws and formal complaint procedures. While RTO can be a viable bridge to ownership, it pays to walk in with eyes open: know which protections apply in your area, and keep meticulous records from day one.

Vehicle Condition, Maintenance, and Insurance Realities

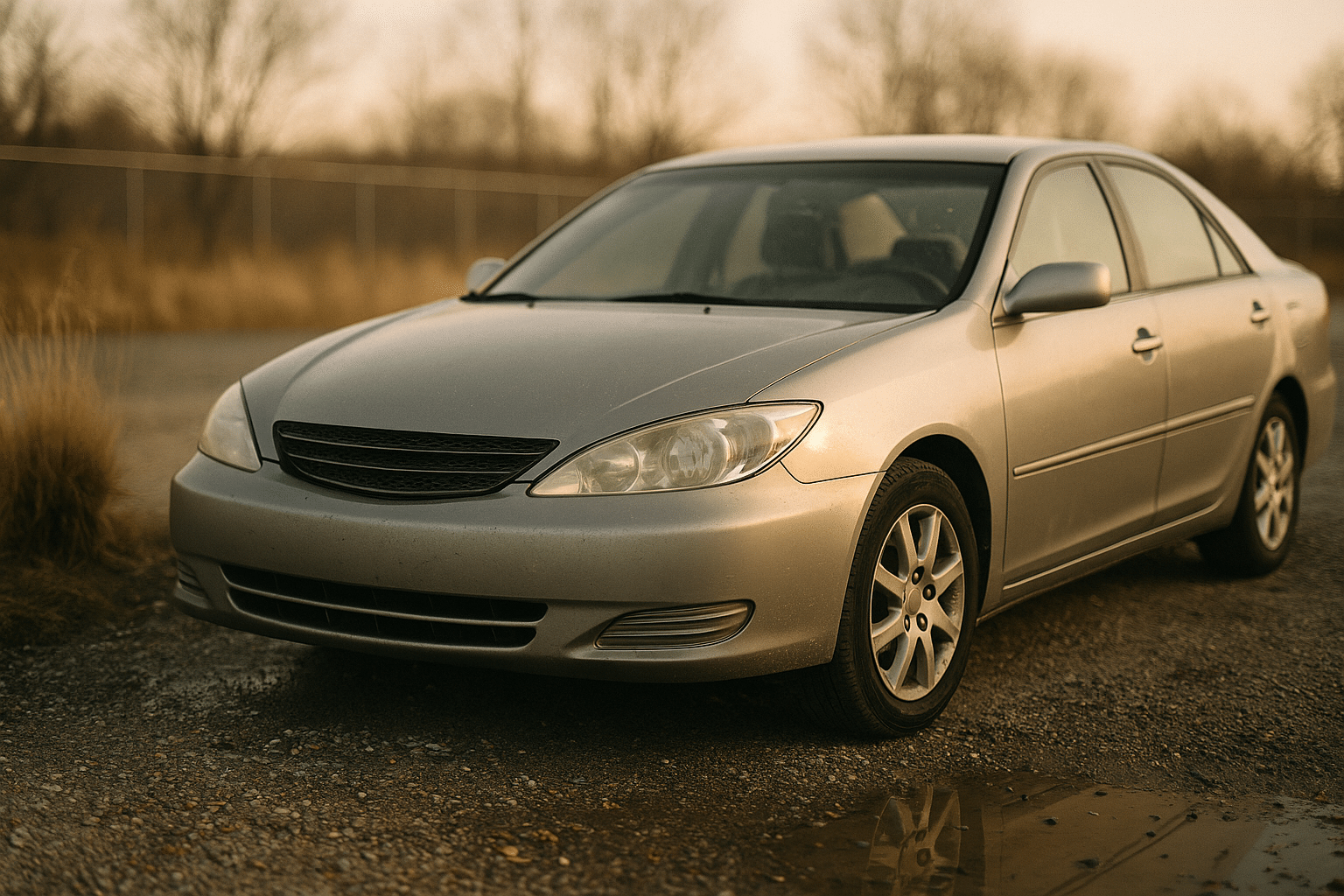

RTO fleets often consist of used vehicles with varying histories. Your goal is to choose a car that matches your commute and budget while minimizing surprise repairs. Start with a careful inspection in daylight and, if possible, a brief independent evaluation. Used vehicles can be reliable when serviced consistently, but neglected maintenance can surface as brake wear, aging tires, fluid leaks, or battery issues shortly after you drive off the lot.

A practical inspection list:

– Exterior: check panel gaps, paint overspray, uneven tire wear, windshield chips, and headlamp haze.

– Interior: test all switches, listen for blower noises, inspect seat belts, and sniff for mildew (possible water intrusion).

– Underhood: look for fluid residue, cracked belts, discolored coolant, and corroded terminals.

– Road test: verify smooth shifts, straight tracking under braking, and consistent engine temperature.

Maintenance expectations are straightforward in many RTO contracts: you handle routine service, and the provider may cover limited, clearly defined failures for a short window. Ask whether the agreement includes or sells optional service plans. Even without one, a simple budget can help: set aside a small weekly amount for maintenance—say $15–$25—so tires, brakes, and fluids don’t derail your payment schedule when they come due.

Insurance is another critical layer. Most contracts require at least liability coverage that meets local minimums; some also require comprehensive and collision to protect the asset. Premiums vary by region, driver record, and vehicle category. Steps to manage insurance cost include choosing a higher deductible if feasible, bundling with existing policies, and reviewing mileage and usage data if your insurer offers usage-based options. Confirm whether the provider requires proof of coverage before release and whether there are penalties or repossession rights tied to lapsed insurance.

Telematics devices, common in RTO, can enable quick recovery after default. Understand the privacy policy: what is tracked (location, ignition status), how long data is stored, and who can access it. If the contract includes a starter-interrupt, clarify the grace period and notification process to avoid a disabled vehicle at an inconvenient time.

Finally, match the vehicle to the job. A compact commuter car may keep fuel and tire costs manageable for city driving, while a larger vehicle can carry family and cargo at the expense of higher operating costs. Picking the right size and condition reduces both stress and spend over the life of the agreement.

Alternatives to Rent-to-Own and a Practical Decision Framework

Rent-to-own is one of several paths to reliable transportation. Depending on your credit, income stability, and timeline, alternatives may deliver similar utility with different trade-offs. A traditional loan spreads costs over predictable monthly payments and can build credit with on-time reporting, but approval requires sufficient score and income. Community lenders and cooperatives sometimes offer flexible underwriting and financial counseling, which can reduce total cost for qualifying members. Short-term rentals and car subscriptions bundle maintenance and, in some cases, insurance; they can be efficient for sparse driving but expensive for daily commuting.

Other routes to consider:

– Save-to-buy: combine public transit, rideshare, or occasional rentals while setting aside a fixed weekly amount, targeting a cash purchase in months instead of years.

– Co-signer loan: if available, it can unlock lower rates, but both parties share responsibility for timely payment.

– Employer programs: some workplaces offer transport stipends or partner discounts on transit or rentals.

– Seasonal strategies: purchase during quieter sales periods when used inventory pricing softens in your area.

A quick decision framework helps align the choice with your needs:

– If you need a car immediately and lack traditional credit approval, RTO offers rapid access with a known premium.

– If you can wait 60–120 days, consider save-to-buy or seek preapproval with a community lender; the total cost may be significantly lower.

– If your driving is occasional, mix transit with short-term rentals or subscriptions to avoid long-term commitments.

– If you’re rebuilding credit, prioritize solutions that report on-time payments reliably.

Conclusion: Making a Confident Choice

Your situation drives the decision. If the priority is getting to work this week with minimal barriers, rent-to-own can serve as a practical bridge. If you have time to plan, comparing preapproved loans, subscriptions, and save-to-buy timelines may reveal a more economical route. Whichever path you choose, run the numbers on the same footing, read disclosures line by line, and budget for insurance and maintenance from day one. With clear math and a realistic plan, you can secure dependable transportation while protecting your long-term finances.