Find Reliable Payroll Software Solutions

Introduction to Payroll Software

Payroll software has become an essential tool for businesses of all sizes. As companies strive to streamline their operations, finding reliable payroll software solutions is crucial for managing employee compensation efficiently. These systems automate the complex process of calculating wages, withholding taxes, and ensuring compliance with labor laws. The importance of payroll software cannot be overstated, as it not only saves time but also minimizes errors that could lead to costly penalties.

Key Features of Payroll Software

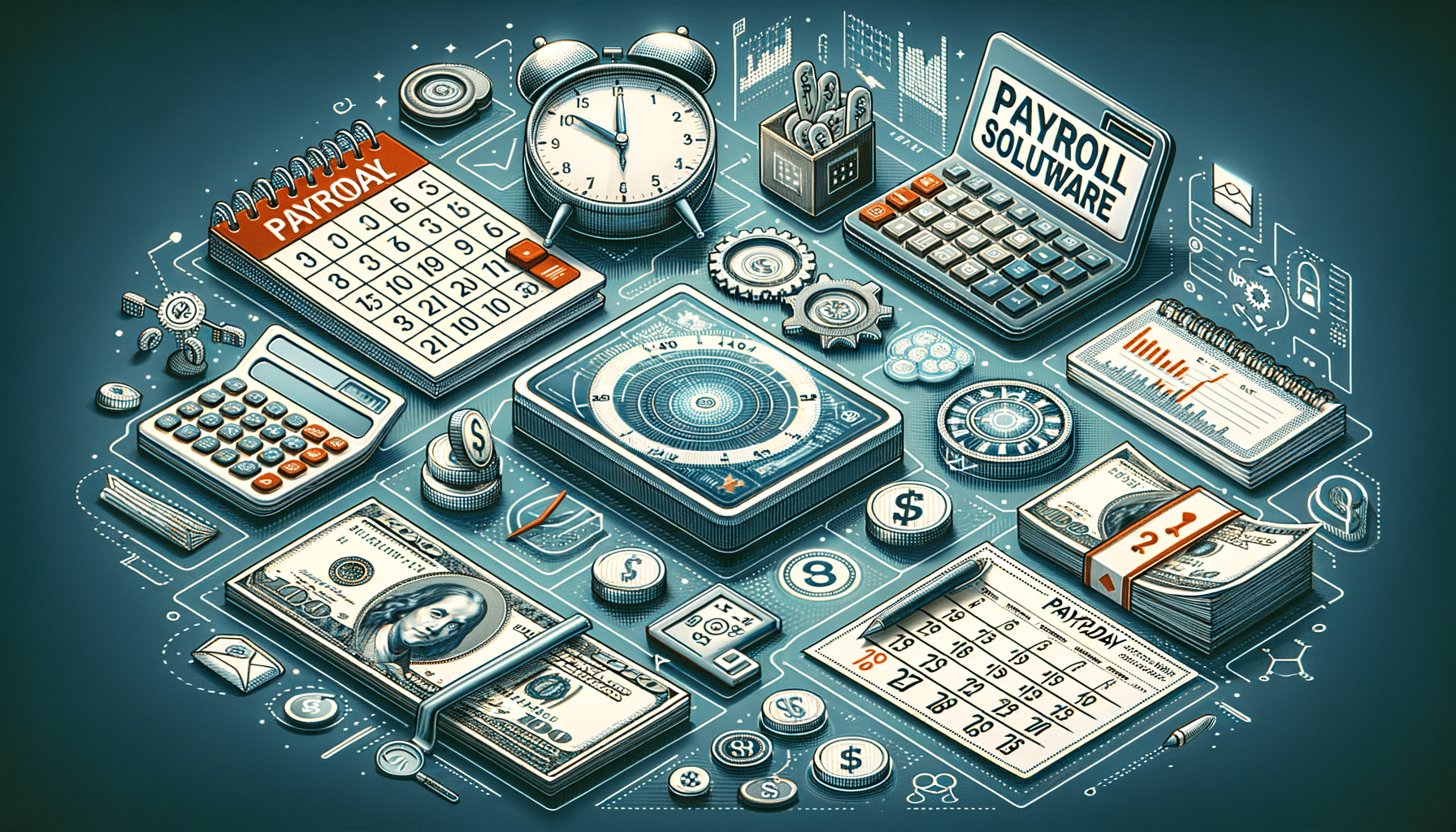

When searching for payroll software, it’s important to consider the features that will best meet your company’s needs. Reliable payroll software solutions often include:

- Automated tax calculations and filings to ensure compliance with local and federal regulations.

- Direct deposit capabilities to streamline payment processes.

- Employee self-service portals for accessing pay stubs and tax documents.

- Integration with other HR and accounting systems for seamless operations.

These features help businesses maintain accuracy and efficiency in payroll processing, reducing the administrative burden on HR departments. By leveraging these capabilities, companies can focus more on strategic initiatives rather than getting bogged down in administrative tasks.

Benefits of Using Payroll Software

Implementing payroll software offers numerous benefits to businesses. One of the most significant advantages is the reduction in manual errors. Human calculations are prone to mistakes, especially when dealing with complex tax regulations. Payroll software automates these calculations, ensuring accuracy and compliance.

Additionally, payroll software provides enhanced security for sensitive employee information. With data encryption and secure cloud storage, businesses can protect their employees’ personal and financial data from unauthorized access. This level of security is crucial in today’s digital age, where data breaches are becoming increasingly common.

Choosing the Right Payroll Software

Selecting the right payroll software involves considering several factors. First, assess the size of your business and the complexity of your payroll needs. Small businesses may require a simpler solution, while larger companies with diverse payroll requirements might need more comprehensive software.

Another consideration is budget. Look for affordable payroll software options that offer the features you need without unnecessary extras. Many providers offer scalable solutions, allowing you to start with basic features and expand as your business grows.

Finally, consider the level of customer support provided by the software vendor. Reliable support is essential for resolving any issues that may arise and ensuring smooth payroll operations.

Conclusion: Finding the Right Fit

In conclusion, finding reliable payroll software solutions is a critical step in optimizing your company’s payroll processes. By understanding your business’s specific needs and evaluating the features and benefits of different software options, you can select a solution that enhances efficiency and accuracy. Remember to consider factors such as cost, scalability, and customer support when making your decision. With the right payroll software, you can streamline operations, reduce errors, and focus on growing your business.